Though hardware and software constraints have limited growth until now, the app ecosystems around watchOS and Android Wear will accelerate over the medium term. Smartwatches will become more indepentent from smartphones as the use of embedded sims increases. All in all, 7.5 million smartwatches with cellular capacity will be shipped in 2016, growing to 53.6 million in 2020, a compound annual growth rate (CAGR) of 63 percent during the period 2016-2020.

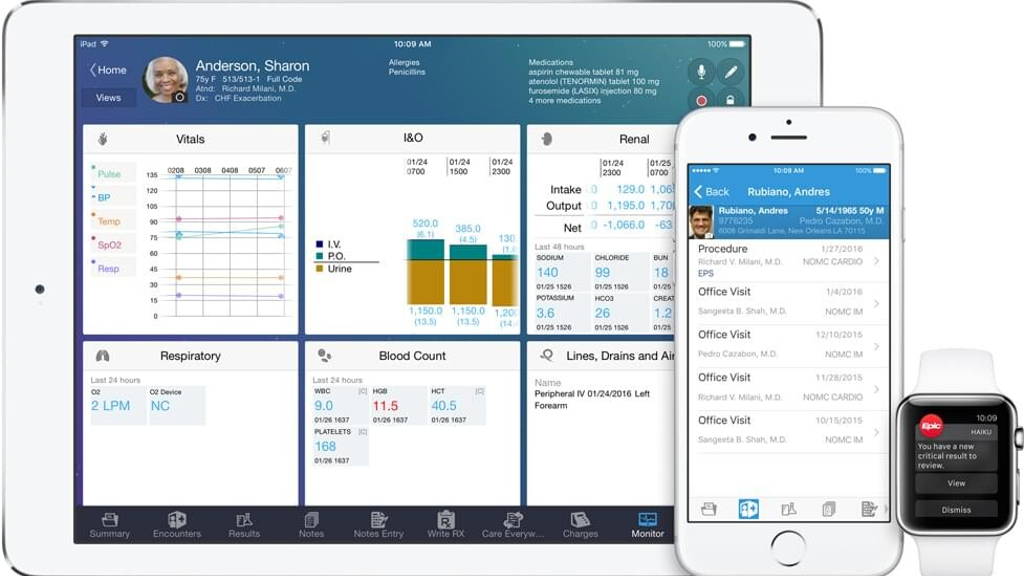

Samsung recently added integration to its S Health platform for fitness apps and devices by Strava, Fitbit, Jawbone, Misfit and Microsoft Health. Apple focusses on health en (medical) research user cases for its smartwatch, based upon its developer kits HealthKit, CareKit and ResearchKit. The Apple watch has gained a prominent place in Apples broader ehealth strategy.

"The immediate use case will be to make telephone calls, but it goes well beyond that. Cellular connectivity on a wearable can transmit and receive data, including time, location, and other data about a user and his or her surroundings. Imagine what that means when tracking steps, analyzing patient activity, or shopping: the information can be shared immediately with a second or third party, and the user can, in turn, receive context appropriate information back.”

While smartwatches are in the spotlight today, future growth will come from basic watches that provide some sort of fitness/sleep tracking while not being sophisticated enough to run third party applications on the watch itself. Traditional fashion brands like Fossil and health/fitness companies like Fitibit and Withings will help this segment grow.

Apple, Samsung, LG drive cellular growth

In the short term, shipments are likely to be driven by a new Apple Watch - expected in september this year - with cellular connectivity. Samsung and LG have been very aggressive in bringing new cellular technologies to market, with smart watches such as the Gear S2 classic 3G/4G and the Watch Urbane 2nd Edition LTE, and will also play significant roles. Both the Tizen and Android Wear smart watch platforms already support cellular connectivity.Samsung recently added integration to its S Health platform for fitness apps and devices by Strava, Fitbit, Jawbone, Misfit and Microsoft Health. Apple focusses on health en (medical) research user cases for its smartwatch, based upon its developer kits HealthKit, CareKit and ResearchKit. The Apple watch has gained a prominent place in Apples broader ehealth strategy.

IDC: cellular smartwatches analyse patient activity

In June IDC stated that two factors driving the wearables market forward are cellular connectivity and applications. "Cellular connectivity essentially frees the wearable from being tethered to a smartphone," said Ramon T. Llamas, research manager for IDC's Wearables program."The immediate use case will be to make telephone calls, but it goes well beyond that. Cellular connectivity on a wearable can transmit and receive data, including time, location, and other data about a user and his or her surroundings. Imagine what that means when tracking steps, analyzing patient activity, or shopping: the information can be shared immediately with a second or third party, and the user can, in turn, receive context appropriate information back.”

While smartwatches are in the spotlight today, future growth will come from basic watches that provide some sort of fitness/sleep tracking while not being sophisticated enough to run third party applications on the watch itself. Traditional fashion brands like Fossil and health/fitness companies like Fitibit and Withings will help this segment grow.